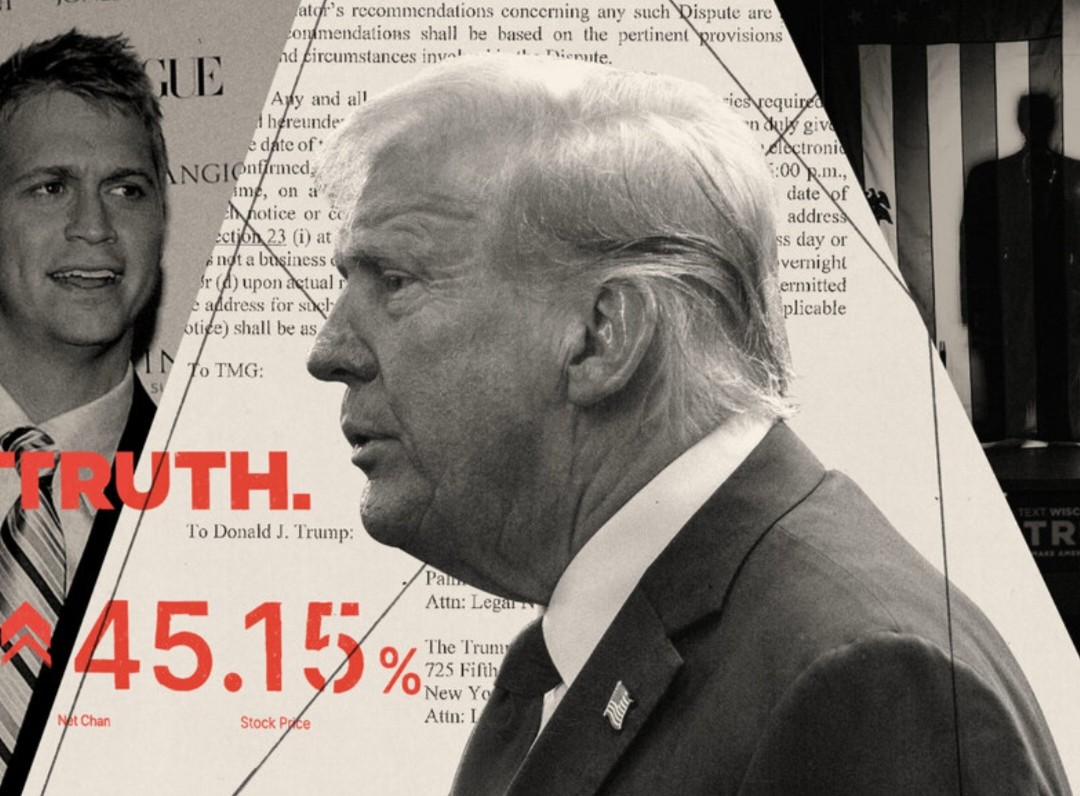

Trump Media & Technology Group (TMTG) is a digital media company launched by former U.S. President Donald Trump. The company was established as a counter-platform to mainstream social media networks, which Trump claimed were biased and suppressing conservative voices. TMTG announced plans to launch a new social media app, TRUTH Social, along with other digital products to compete with Silicon Valley tech giants. The market reception to Trump Media Stock has been mixed.

On one hand, the company’s shares surged dramatically after its announcement, reflecting a strong support base and the potential for considerable user growth. This enthusiasm was primarily driven by Trump’s loyal followers and investors anticipating high demand for the platform. On the other hand, skeptics question the platform’s long-term viability given the intense competition in the social media space and the technological challenges the company may face.

Furthermore, some investors are cautious due to the company’s decision to go public through a Special Purpose Acquisition Company (SPAC), a method often seen as risky. Despite these concerns, it is evident that TMTG has created a significant buzz in the market, with its performance in the coming months and years likely to be closely watched by both supporters and critics.

Investor Concerns: Issues Raised with the SEC

Investor concerns are often directed to the Securities and Exchange Commission (SEC), a government agency tasked with protecting investors and maintaining fair, orderly, and efficient markets. The issues raised can vary widely, but typically revolve around several common themes. For instance, many investors express worries about transparency, fearing that companies may not be revealing all necessary information about their financial health and operational activities. This can make it difficult for investors to make informed decisions and can potentially lead to significant financial loss.

Another issue that regularly comes up is the lack of enforcement against fraudulent activities. While the SEC does have a division dedicated to enforcement, some investors feel that this is not sufficient and that more needs to be done to prevent and punish fraudulent behavior. In particular, there is concern about high-profile cases where executives seem to escape severe penalties, which can create a perception of a double standard in the enforcement of regulations.

Another major concern is the fairness of the market. Some investors worry that large institutional investors and hedge funds have unfair advantages over individual investors. This could be due to their access to better information, their ability to influence market prices, or their capacity to take on more risk.

Investors also raise issues about the complexity of financial products and the difficulty of understanding them. Some financial instruments, like derivatives, can be incredibly complicated and opaque. This complexity can make it easy for unscrupulous actors to take advantage of less knowledgeable investors, leading to demands for more education and transparency in the financial industry.

Finally, there are concerns about the role of technology in investing. With the rise of algorithmic trading and high-frequency trading, some investors worry that they are being left behind and that these new technologies are creating more volatility in the markets. They call on the SEC to regulate these practices and ensure a level playing field for all investors. These concerns and more underline the importance of the SEC in maintaining confidence in the financial markets.

Regulatory Response: SEC’s Role in Addressing Investor Grievances

The United States Securities and Exchange Commission (SEC) plays a vital role in addressing concerns and grievances from investors, thereby ensuring that the financial markets function in a fair and efficient manner. As the primary overseer of the securities industry, the SEC is responsible for addressing investor grievances, predominantly through the enforcement of regulations designed to promote transparency and minimize fraudulent activities.

One of the primary tasks of the SEC is to ensure that public companies adhere to reporting requirements. These requirements involve the release of financial information that can assist investors in making informed investment decisions. When investors feel their rights have been violated or they have been misled, they can file complaints with the SEC.

To address such grievances, the SEC investigates the claims and takes necessary actions, which can range from imposing fines, suspensions, or penalties to revoking a firm’s ability to trade. The SEC also provides education and resources to investors, empowering them to protect themselves against potential misconduct. It is crucial to note that the SEC’s involvement in addressing investor grievances is not limited to reactive measures.

The commission proactively engages with investors and other stakeholders to understand market trends, potential risks, and areas that may require regulatory intervention. Through these efforts, the SEC aims to maintain the integrity of the U.S. financial markets, boost investor confidence, and encourage economic growth.

Market Reaction and Volatility: Impact on Trump Media Stock Prices

Market Reaction and Volatility: Impact on Trump Media Stock Prices is a fascinating subject to explore. The financial markets are known to be sensitive, responding to various elements, including political events, global crises, and public figures’ actions. In this context, the influence of Donald Trump, as an influential figure, on media stock prices is substantial. Upon the announcement of his media company, Trump Media and Technology Group (TMTG), the stock market witnessed an unprecedented surge in the company’s stock prices. This increase was a direct response to investors’ anticipation of the potential impact of this launch, reflecting the market’s sensitivity to political figures and their ventures.

However, the stock market is also characterized by volatility, which means the prices of stocks can fluctuate wildly in a short period. For instance, the prices of TMTG stocks experienced significant volatility, with sharp increases followed by steep declines. This volatility can be attributed to several factors, including the uncertainty surrounding the future prospects of Trump’s media venture, fluctuating investor sentiment, and the overall unpredictability of the stock market. Despite the initial surge in TMTG stock prices, the subsequent volatility underscores the risks associated with investing in such ventures.

Furthermore, the reaction of the stock market to the launch of TMTG also illustrates the influential role of media in shaping investor sentiment. News about Trump’s venture was widely covered in the media, contributing to the initial investor excitement and the subsequent surge in stock prices. However, as media coverage evolved and different perspectives on the venture’s viability emerged, investor sentiment shifted, leading to increased volatility in TMTG stock prices.

In conclusion, the impact of Trump’s media venture on stock prices reveals the complex dynamics at play in the stock market. It underscores how market reactions and volatility are influenced by a myriad of factors, including political figures, media coverage, and investor sentiment.

Future Outlook: Potential Implications for Trump Media and Investor Confidence

The future outlook for Trump Media and Technology Group (TMTG), despite its substantial initial fundraising, is intrinsically tied to a number of potential implications that could influence investor confidence. The political landscape and current public sentiment towards its figurehead, former President Donald Trump, is a significant factor to consider.

Given the polarizing nature of his tenure, there is a risk that the platform may struggle to attract a diverse user base, which could potentially impact its market value and growth prospects. Additionally, the company’s ability to navigate the complex regulatory environment, particularly in terms of content moderation and data privacy, is another key concern. Any missteps in these areas could lead to substantial reputational damage and financial penalties, thereby affecting investor sentiment.

Furthermore, TMTG is entering an already saturated social media market dominated by established giants such as Facebook, Twitter and Google. The challenge of gaining a strong foothold and maintaining user engagement in such a competitive space should not be underestimated. Likewise, the company’s technological infrastructure and its ability to deliver a seamless user experience will be critical to its success and, by extension, its appeal to investors. In the digital age, a platform’s resilience to cybersecurity threats is also a crucial factor in maintaining user trust and investor confidence.

In conclusion, while TMTG has garnered significant attention due to its association with a prominent political figure, its future outlook is contingent upon a multitude of factors. These include public opinion, regulatory compliance, market competition, technological proficiency, and cybersecurity resilience. These factors could either bolster or undermine investor confidence in the company, thus shaping its prospects in the foreseeable future.

Conclusion

A conclusion, in its most general sense, represents the final point or result that is arrived at after careful consideration or analysis of something. It is the end product of a process, whether that be a line of reasoning, a scientific experiment, a piece of writing, or a business project.

It is where all the threads of an argument or investigation are drawn together and the key findings or outcomes are articulated. In a debate or a piece of academic writing, for example, the conclusion is typically where the author or speaker will summarize their main points, restate their thesis in light of the arguments or evidence presented, and perhaps offer some final thoughts or implications.

A conclusion should be clear and decisive, providing a satisfying sense of closure and leaving no important questions unanswered. At the same time, it may also open up new avenues of thought or inquiry, suggesting directions for further research or discussion. As such, while it marks an endpoint, a conclusion is also a launching pad, leading readers or listeners forward into new understanding or action.

It is not just a summary or a recap, but a vital part of the communication process, serving to underscore the significance of what has been said or done and to guide the audience’s reaction or response. In sum, a conclusion is a powerful and necessary tool, enabling us to make sense of our ideas, our discoveries, and our work, and to share that understanding with others.